Goal of this project

The goal of this project is to develop a customer segmentation to define marketing strategy. The sample Dataset summarizes the usage behavior of about 9000 active credit card holders during the last 6 months. The file is at a customer level with 18 behavioral variables.

- Data includes transactions frequency, amount, tenure etc

- Leverage K-means clustering and PCA to do the segmentation

Analysis

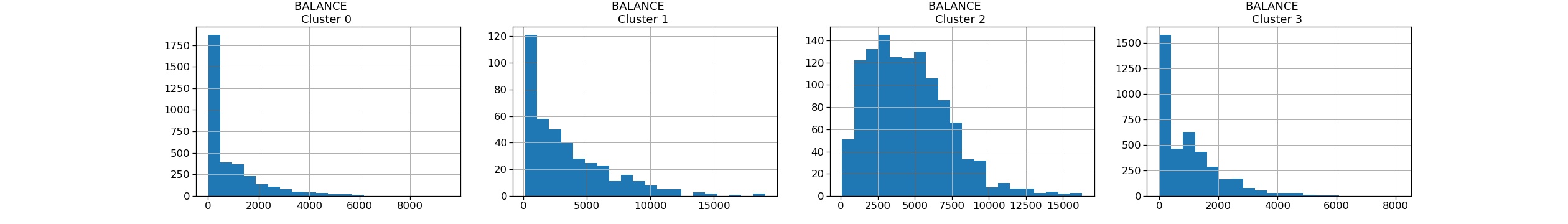

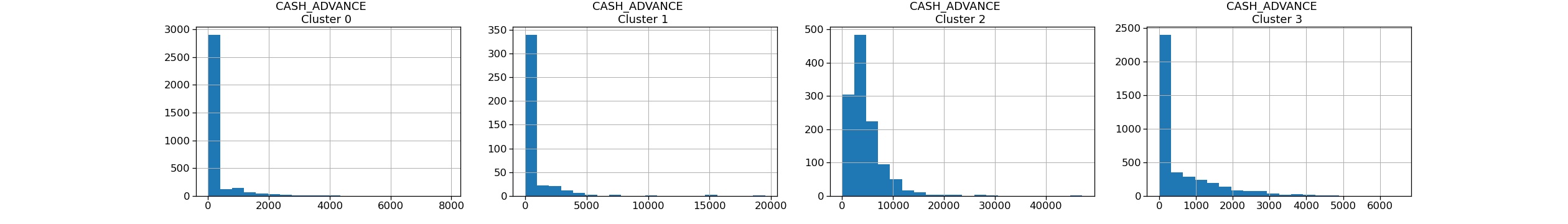

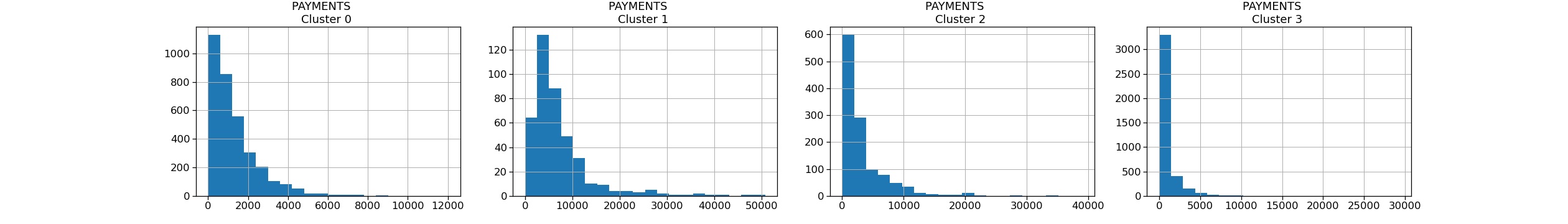

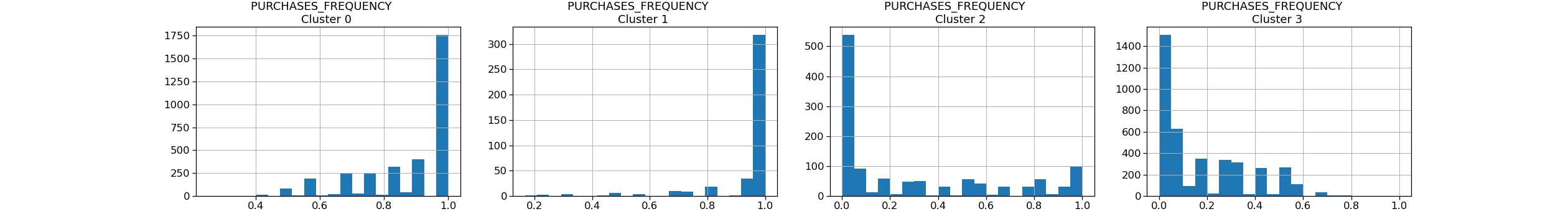

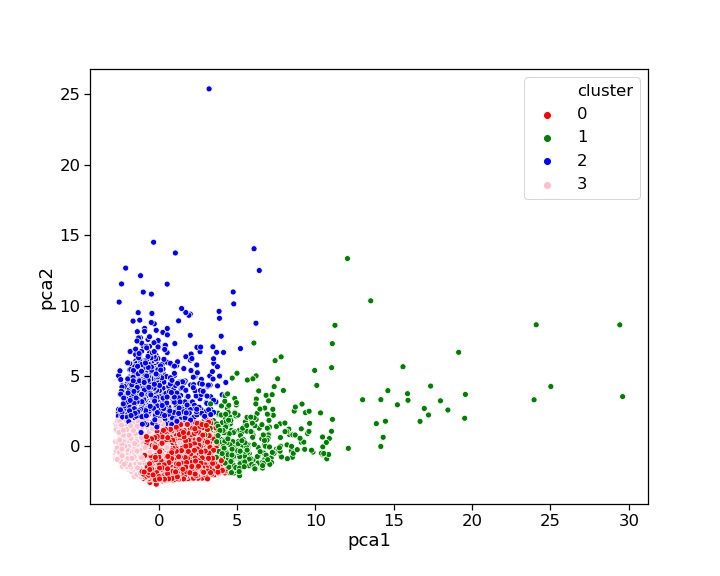

- First Customers cluster (Transactors): Those are customers who pay least amount of interest charges and careful with their money, Cluster with lowest balance (105 dollars) and cash advance (308 dollars), Percentage of full payment = 23%

- Second customers cluster (revolvers) who use credit card as a loan (most lucrative sector): highest balance (5000 dollars) and cash advance (~5000 dollars), low purchase frequency, high cash advance frequency (0.5), high cash advance transactions (16) and low percentage of full payment (3%)

- Third customer cluster (VIP/Prime): high credit limit dollars 16K and highest percentage of full payment, target for increase credit limit and increase spending habits

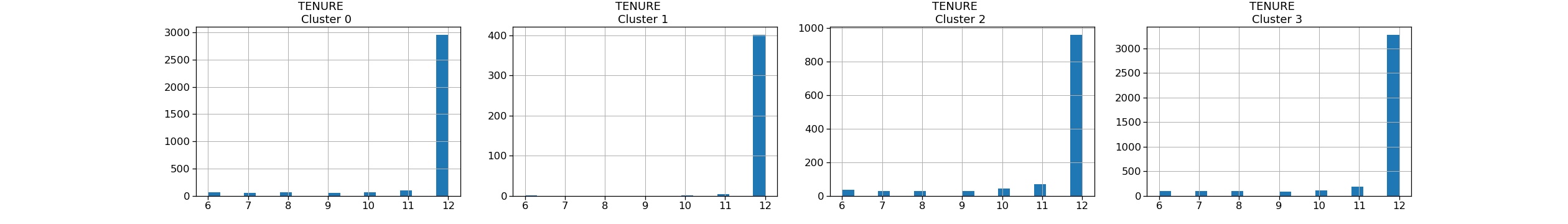

- Fourth customer cluster (low tenure): these are customers with low tenure (7 years), low balance

K-means clustering visuals

First two principal components visuals

License of the source data

Creative Commons Public Domain Dedication This license is one of the open Creative Commons licenses and is like a public domain dedication. It allows you, as a dataset owner, to use a license mechanism to surrender your rights in a dataset when you might not otherwise be able to dedicate your dataset to the public domain under applicable law.

Data Source :

Kaggle credit card dataset for clustering

Data Dictionary for Credit Card dataset

| COLUMNS | DESCRIPTION |

|---|---|

| CUSTID | Identification of Credit Card holder (Categorical) |

| BALANCE | Balance amount left in their account to make purchases |

| BALANCE FREQUENCY | How frequently the Balance is updated, score between 0 and 1 (1 = frequently updated, 0 = not frequently updated) |

| PURCHASES | Amount of purchases made from account |

| ONE OFF PURCHASES | Maximum purchase amount done in one-go |

| INSTALLMENT PURCHASES | Amount of purchase done in installment |

| CASH ADVANCE | Cash in advance given by the user |

| PURCHASES FREQUENCY | How frequently the Purchases are being made, score between 0 and 1 (1 = frequently purchased, 0 = not frequently purchased) |

| ONEOFF PURCHASES FREQUENCY | How frequently Purchases are happening in one-go (1 = frequently purchased, 0 = not frequently purchased) |

| PURCHASES INSTALLMENT FREQUENCY | How frequently purchases in installments are being done (1 = frequently done, 0 = not frequently done) |

| CASH ADVANCE FREQUENCY | How frequently the cash in advance being paid |

| CASH ADVANCE TRX | Number of Transactions made with “Cash in Advanced” |

| PURCHASES TRX | Number of purchase transactions made |

| CREDIT LIMIT | Limit of Credit Card for user |

| PAYMENTS | Amount of Payment done by user |

| MINIMUM_PAYMENTS | Minimum amount of payments made by user |

| PRC FULL PAYMENT | Percent of full payment paid by user |

| TENURE | Tenure of credit card service for user |